Unfortunately, the nature of accepting credit cards, means you may run into an issue where a customer or vendor in your market disputes a charge to their card processed through Marketspread.

If this happens, you will receive an email notification, and you will also be able to review a record of the dispute by navigating to the Disputes screen, by clicking "disputes" from the left hand navigation panel.

You will see here a list of any disputes if you have them.

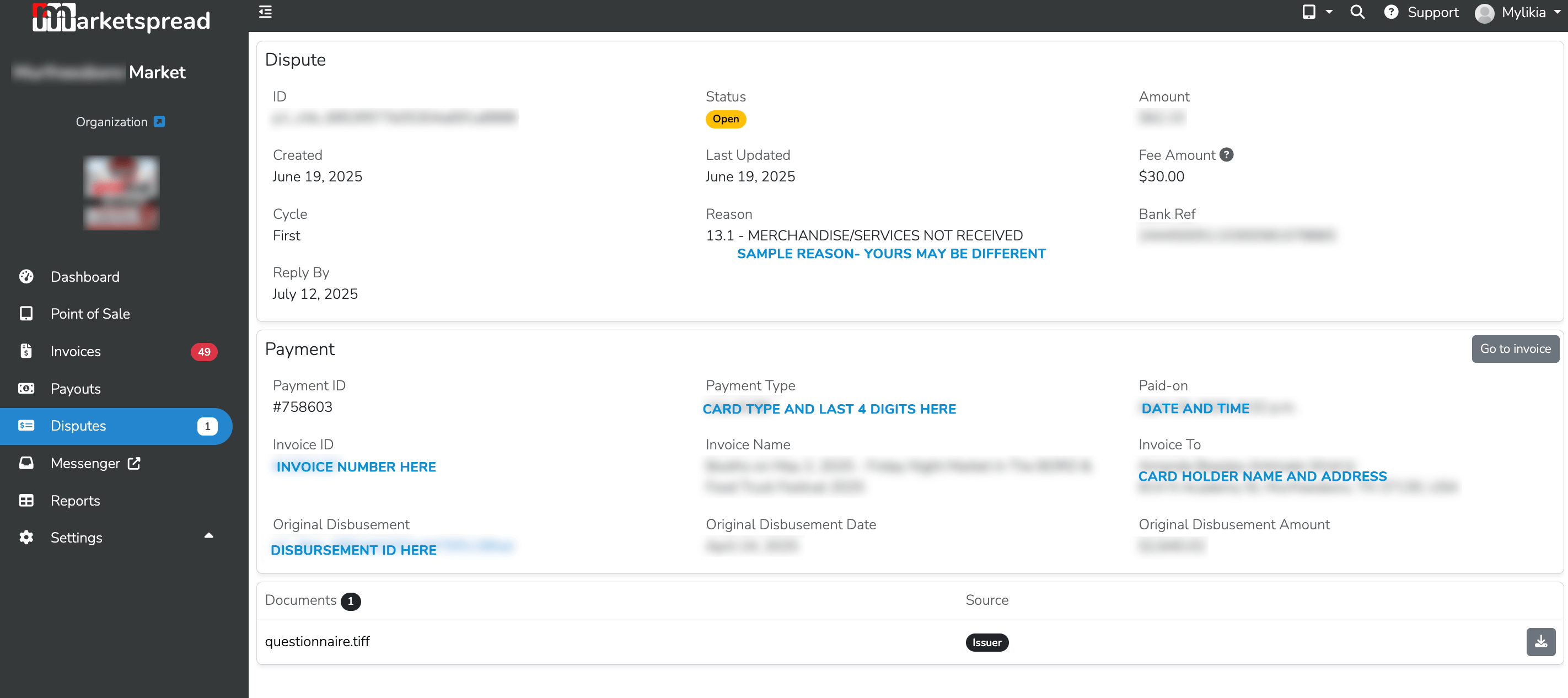

If you click on a dispute, you will see this panel:

An important item to note in this view is the "Reply By" date. This is the date by which you must respond to the dispute to support your claim that the charge is valid.

To respond to a dispute-

please send a message and any supporting evidence to [email protected]

We will then pass this along to the processor who will work with the card companies to resolve the claim.

It also may be a good idea to talk to the cardholder and ask them to contact their bank to withdraw their dispute.

YOU MUST SEND DOCUMENTATION EVIDENCE IN PDF FORM. The processor will not accept a response without documentation, and they will not accept any documentation not in PDF form. Some documentation could be receipts, vendor agreements, proof of attendance, social media posts, relavant email communication with the cardholder or something else that supports your charge.

After evidence is submitted, you will see updates here in the dispute view, or you may receive an upddate via email. Note- every dispute also incurrs a fee regardless if the card companies find in your favor or that of the cardholder.

You will see the decision by the card companies on your disputes page.

NOTE: sometimes, after an initial result of "won" - the cardholder or the card company will "escalate" the dispute.

This stage is called "pre-arbitration" and this is the processor's note about pre-arbitration:

Even though you may have won the first chargeback cycle, the cardholder or card company submitted new evidence, resulting in a second chargeback. This is commonly referred to as "arbitration" or "pre-arbitration" When this occurs- should you choose to accept arbitration- you may send new evidence to arbitrate the dispute.

However, if you choose to accept arbitration - you will be subject to additional arbitration fees that vary depending on the card brand and coud exceed hundreds of dollars.

It is the processor's advice to consider the amount of the charge before you continue to arbitration.

Disputes do not happen often! But this article has shown you how to manage one if it happens to you.